In this edition of mba Aviation’s Insight Series, Sloane Churchill, Analyst – Asset Valuations, uses analysis of the effect of the SARS outbreak of 2002-2003 on aircraft values and the aviation industry to provide insight on how today’s Coronavirus might take its toll.

Key Concepts:

- SARS increased volatility of market values for older vintage and out of production aircraft types more than newer vintage and in-production types, though market values generally recovered within three quarters. It is likely Coronavirus will similarly effect aircraft market values in the short term, but will have no long-term effects.

- The timing of the Coronavirus outbreak over the Chinese New Year, slowing economic growth in China, and extensive travel restrictions are expected to make a larger dent in RPK’s than during SARS.

- No health epidemic of the past 20 years has had a long-term effect on global financial markets, with most recovering with a year. While global airline stocks have taken an immediate hit due to the Coronavirus outbreak, it is not anticipated to have long-term effects on airline stocks.

The Possible Effect of the Coronavirus Outbreak on the Aviation Industry and Aircraft Values

Though the Coronavirus outbreak in China is reminiscent of the SARS outbreak in 2002 – 2003, the effects on the aviation industry have the potential to be quite different. So far, the Coronavirus has infected over 45,000 people, mostly in mainland China, leading to over 1,100 deaths. This Coronavirus is proving to be faster spreading, though less deadly than SARS, with a death rate of approximately 2.1%. Historically, while global health epidemics have hurt aviation by reducing revenue passenger kilometer (RPK) growth in the short term, there have been no long-term effects for any epidemic of the last twenty years, including SARS, Avian Flu, Swine Flu, Ebola, or Zika on aircraft values or the aviation market as a whole.

The SARS outbreak could provide some insight as to how aircraft values and the aviation industry might be affected by the current Coronavirus. mba values research shows SARS disproportionately affected aircraft values. Typically, older vintage and out of production aircraft were hit the hardest after the SARS outbreak, showing the most value volatility in the following two years. Newer vintage and current production aircraft were significantly less volatile.

Market values for aircraft and Brent Crude prices have historically had an inverse relationship; in low fuel price environments, aircraft values tend to increase as aircraft become less expensive to operate, while market values decrease in high fuel price environments. This is especially apparent in older vintage and out of production aircraft, as they are less fuel efficient, and thus more sensitive to fuel price. However, 9/11 and the SARS epidemic broke the correlation between Brent Crude prices and market values, and this relationship does not recover until after the worst point of the SARS epidemic in 3Q 2003 for most aircraft types and classes. After the SARS outbreak, looking at narrowbody aircraft, the market value of a 1988 737-400 and A320-200 fell 14.8% and 42.0% respectively in 1Q 2003 from the previous quarter, while market values for a 1998 737-400 and A320-200 fell 15.1% and 16.7% respectively in 1Q 2003. Market values for a 1998 737-800, which technologically replaced the 737-400, dropped 11.2%. At the same time, Brent Crude prices fell 3.5% from the previous quarter during 1Q 2003.

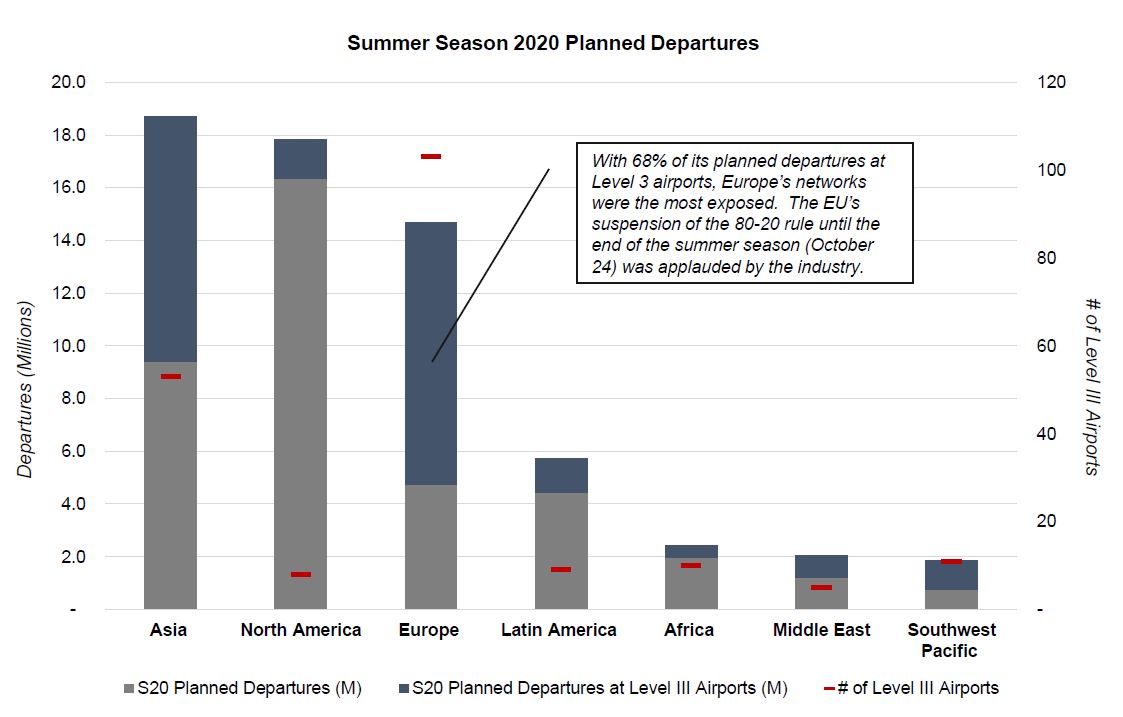

Generally, narrowbody aircraft values recovered by 3Q 2004 and show no long-term effects from the SARS outbreak. However, there were only limited travel restrictions in place during the SARS outbreak, while travel restrictions in China and internationally during this Coronavirus outbreak have been significantly more extensive, potentially having a larger effect on RPKs than SARS. The immediate reduction in passenger demand caused by these travel restrictions will likely hit narrowbody values slightly less than widebody values, as carriers will rely more on their narrowbody fleets in the reduced-demand environment, particularly in the domestic Asia market.

Widebody aircraft in particular took the brunt of the value hit during the SARS epidemic, as they potentially will in the quarters following this Coronavirus epidemic as well. Like narrowbodies, widebody values recovered by 3Q 2004. The small to mid-sized widebodies such as the 767-300ER and A330-300 showed less volatility than large widebodies. Market values of older vintage aircraft, such as a 1988 767-300ER and a 1994 A330-300, were affected the most, falling 13.3% and 18.8% respectively in 1Q 2003. The newer 1998 vintage 767-300ER and A330-300 market values fell slightly less at 10.4% and 13.6% respectively. With the A330 currently in a soft market, all vintages, but particularly older vintages, could be vulnerable to further market value volatility, as the A330 is a popular widebody in the Asia/Pacific region. The 787, also a popular type in the Asia/Pacific region, could be vulnerable to market value volatility as concerns of overproduction combined with reduced passenger demand might lead to delayed or cancelled deliveries of the type in the near to mid-term.

Large widebodies, such as the 777-200ER and the 747-400 were also heavily affected by the SARS outbreak. Market values for the 1998 vintage 747-400 were hit the hardest by SARS in part because the type was nearing the end of its production run, falling 16.1% in 1Q 2003 while market values for a 1989 vintage only fell 7.7%. This time around, we could see softening of market values for older vintage 777-300ERs, or even the A350-900, as these types are popular on mid to long-haul routes in Asia.

Financial markets took an immediate hit with the shock of the epidemic after the Chinese New Year on January 27th, with the US’s S&P 500 and NASDAQ falling 1.6% and 1.9% respectively, and London’s FTSE 100 Index fell 2.3%. However, so far through the epidemic, the S&P 500 has only fallen 0.16% and the NASDAQ has actually risen 2.0%. Since the Coronavirus was announced, through the end of January, Hong Kong’s Hang Seng Index has fallen 6.7% and Shanghai’s SSE Composite Index has dropped nearly 10.0%.

International airline stocks were also affected, particularly airlines with large international presences and extensive Asian networks. China Eastern Airlines and China Southern Airlines’ stocks have been hit the hardest, both falling around 17.0% during the epidemic, as their networks rely heavily on international routes within Asia and around the globe. The following chart shows how several airlines were affected at various event dates throughout this epidemic, starting December 31, 2019 when China reported a new illness to the WHO, around the weekend of the Chinese New Year, and when the WHO deemed the Coronavirus to be an international public health emergency at the end of January.

Airlines are now more flexible than they were in the early 2000’s, becoming more savvy with capacity and revenue management, making changes to flight schedules just days after the start of the epidemic in response to anticipated drops in demand. Several airlines have cancelled their flights to China altogether, including British Airways, Lion Air, Lufthansa, Air France – KLM, Virgin Atlantic, Delta Air Lines, and American Airlines, with more expected to follow. While cutting flights to and from China might curb the spread of the illness, it could potentially have drastic effects for airlines’ financials. Research conducted by mba’s Forecasting and Modeling Group shows three of the top ten international routes from China to outside of the region by frequency are between China and the United States. United Airlines and American Airlines each serve two of those three routes, with Delta Air Lines serving one route, making them particularly exposed to the travel restrictions. United Airlines is also one of the top ten operators to China by frequency and has taken the largest hit to its stock price so far because of its exposure.

After the SARS outbreak, global financial markets fully recovered within one year, even while continuing to recover from the effects of the 9/11 terrorist attacks. This coronavirus hit during a long boom period for the financial and aviation markets, which may help to mitigate the financial effects of the epidemic on aviation, as most airlines are more flexible and financially fit, and thus more equipped to handle the reduction in passenger demand. The coronavirus has also affected the manufacturers, as Airbus announced it has closed its final assembly line in Tianjin, China in response to the coronavirus. China’s importance to the aviation industry has grown tremendously since the SARS outbreak 18 years ago, and is essential to many global airlines’ growth horizons, which may make this epidemic that much more painful for the industry. The aviation industry’s fears of an economic downturn ahead combined with the potential severity of this epidemic is likely to perpetuate the rash of airline bankruptcies we saw in 2019, as some financially suffering airlines might not cope with the reduced demand. It would also be reasonable to see a slowdown in aircraft transactions and financings in the near to mid-term, though the ABS and EETC markets might hold solid, as they are more long-term instruments.

The timing of the outbreak is also unfortunate for the industry as the Chinese New Year January 25th, China’s largest travel holiday, was effectively cancelled by the outbreak. According to CNN, in 2019 the Chinese New Year accounted for around 73 million trips by air travel. According to IATA, at the worst of the SARS outbreak in May 2003, RPK’s dropped by about 35% with no travel restrictions by countries. Currently, with the travel ban within China and many other countries limiting travel to and from China, RPK’s are expected to take a sizeable hit. With economic growth slowed to 6.1% in 2019, and resulting reduced passenger demand growth in China over the past two years, if the Coronavirus lasts through the quarter, it could have long-term economic effects, unlike prior health epidemics, as Asia grows to be one of the largest aviation markets in the world.

Download PDF